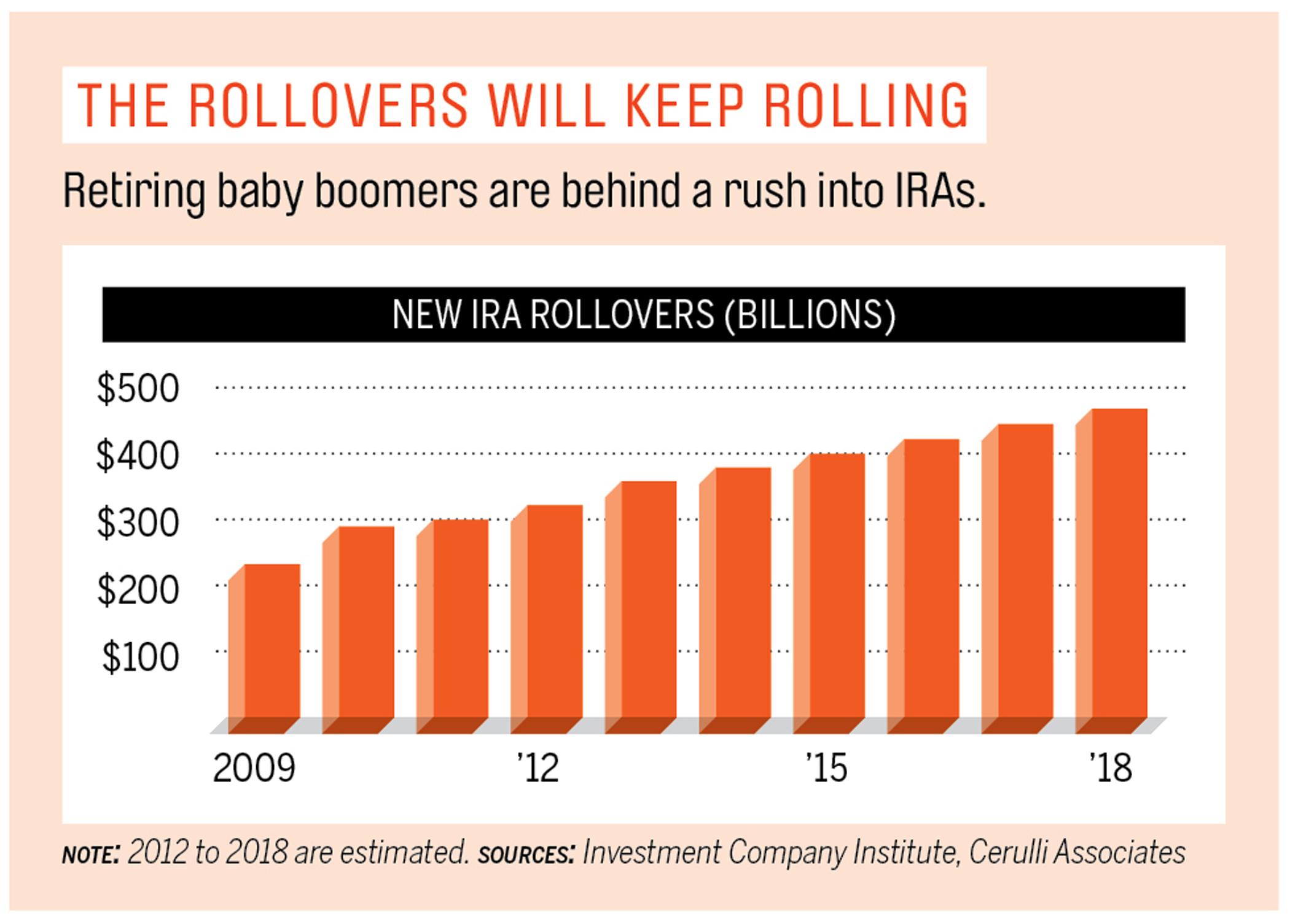

The benefits of rolling over your 401 k or 403 b into an ira rolling over an old employer sponsored retirement plan into an ira can be highly beneficial.

Benefits of rolling a 401k into an ira.

Beyond the type of ira you want to open you ll need choose a financial institution to invest with.

But there are times when a rollover is not your best option.

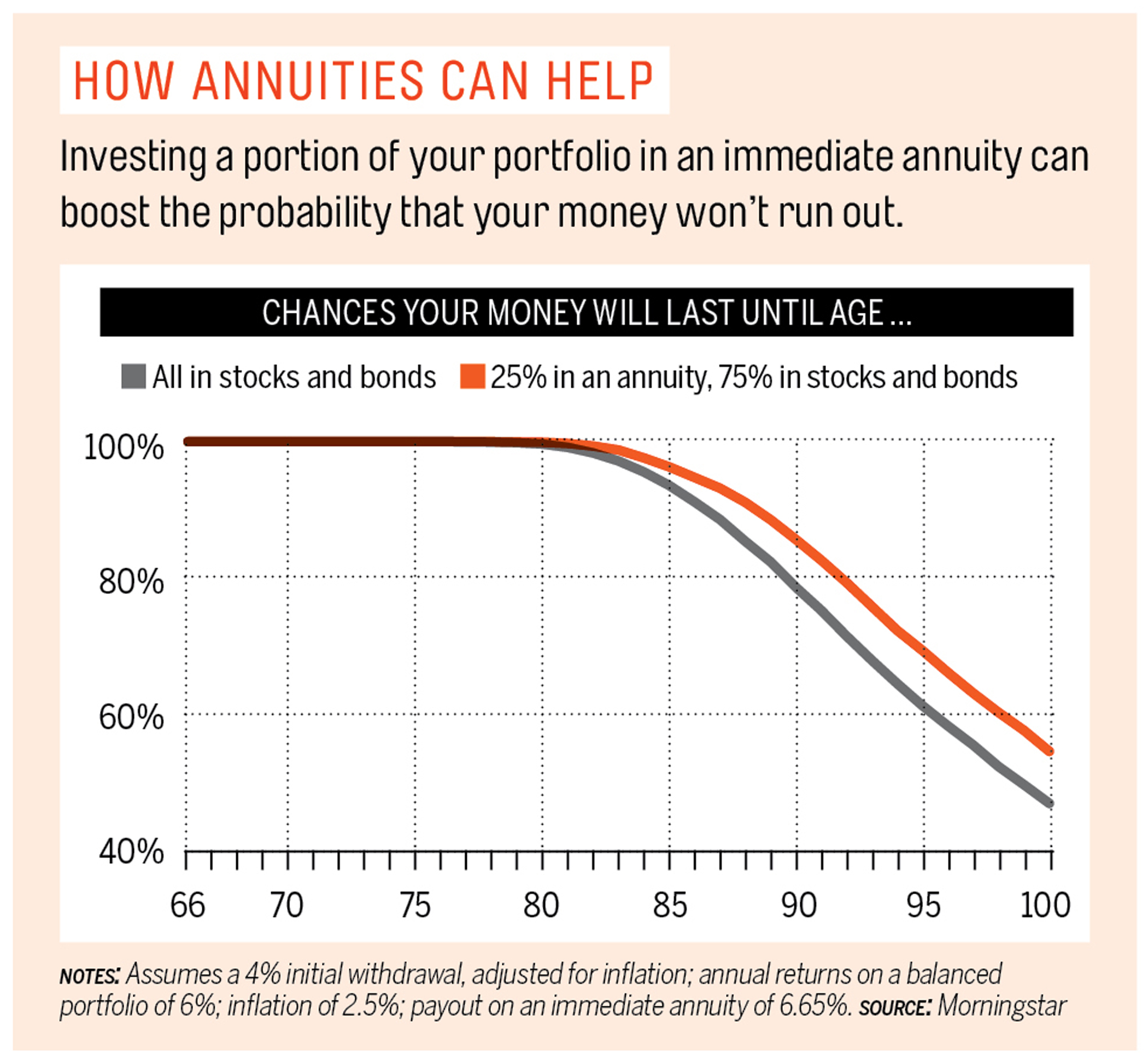

For most people rolling over a 401 k or the 403 b cousin for those in the public or nonprofit sector into an ira is the best choice.

Here are three reasons to consider rolling over a 401 k or 403 b.

Conventional wisdom says to roll it over into an individual retirement account ira and in many cases that is the best course of action.

Below are seven reasons why.

With your former employer or roll it over into an individual retirement account.

You can rollover from a traditional 401 k into a traditional ira tax free.

However you can only roll over.

Pros and cons of rolling your 401 k into an ira we tell you when it makes sense to move your 401 k account to an ira and when it s smart to stay put.

Same goes for a roth 401 k to roth ira rollover.

Consider rolling over your 401 k to an ira when you retire.

A rollover ira is identical to a traditional ira or roth ira in the case of rolling over roth 401 k funds except that the source of the money is not annual contributions.

Instead the money that goes into a rollover ira is money from a previous retirement plan such as a 401 k plan.

Iras maintain the tax benefits of your 401 k.

You can t roll a roth 401 k into a traditional ira.

-page-001_tcm113-118061.jpg)